How To Calculate Exchange Rate Volatility In Excel

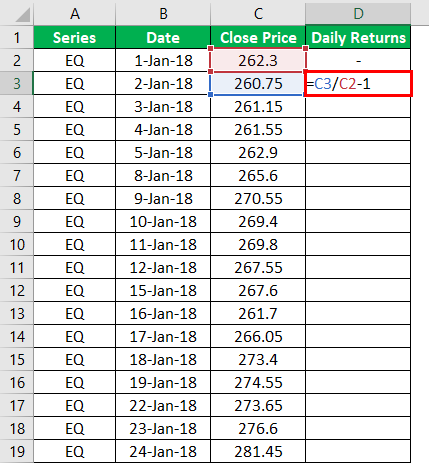

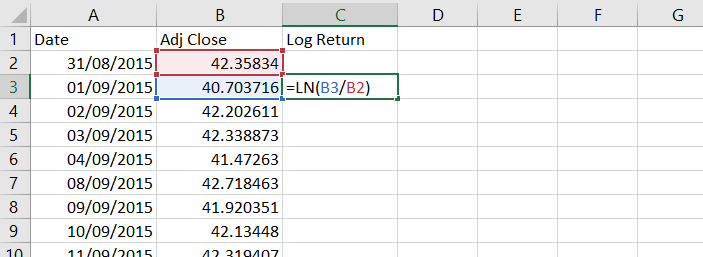

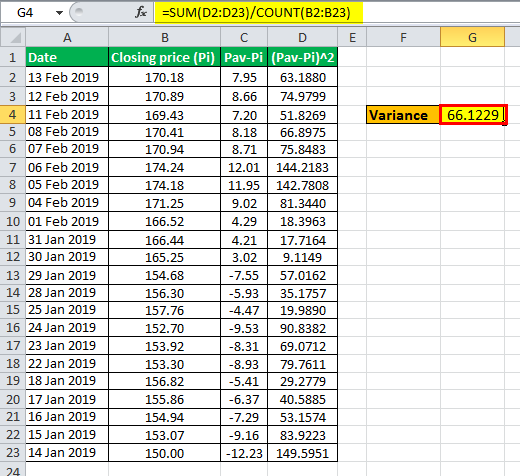

It is also called the Root Mean Square or RMS of the deviations from the mean return. In the first row enter column labels.

How Do You Calculate Volatility In Excel

There are two main style of options on currency pairs a call option and a put option.

How to calculate exchange rate volatility in excel. Underneath the main pricing outputs is a section for calculating the implied volatility for the same call and put option. The foreign exchange spread or bid-ask spread refers to the difference in the bid and ask prices for a given currency pair. Implied Volatility is used to Value Currency Options.

The volatility of the underlying asset. The Ben graham Formula also has a drawback that it considers growth rate as an important element. Here you enter the market prices for the options either last paid or bidask into the white Market Price cell and the spreadsheet will calculate the volatility that the model would have used to generate a theoretical price that is in-line with the.

Probability of Gain A D1. You will be using this template for the analysis. R F rate of return in denominated or foreign currency.

Investment B1Gain A C1. R ex rate of appreciation or depreciation in the exchange rate. If you just want a ball park figure use 2 inflation for the recent past and 3 for the long run.

Volatility Inside Volatility Trading. Excels Goal Seek can be used to backsolve for the volatility of a European Option priced using Black-Scholes given the spot price strike price risk-free rate and time to expiration. This can be calculated as VsqrtS.

Due to recent volatility in foreign exchange leading to sales volatility and buybacks done by the management leading to an. The bid price refers to the maximum amount that a foreign exchange trader is willing to pay to buy a certain currency and the ask price is the minimum price that a currency dealer is willing to accept for the currency. Free-floating The most common model used a free-floating regime is influenced by the forex market.

A method of quoting option contracts whereby bids and asks are quoted according to their implied volatilities rather than prices. Which means that the unsystematic risk of a single stock is its volatility minus its beta scaled by the market volatility. Calculate the volatility.

Calculate Implied Volatility with Excel. 7 pts Find the Black-Scholes prices of a six-month put option and a six-month call option both of which are written on 100000 with a. We calculate the growth rate of each of the line items with respect to the previous year.

BlackScholesOptionModelValueOption Symbol this function will return the value as per the model based on the dividend yield on the underlying asset historical 7 trading day volatility and an expected rate of return of 5. Options traders are often interested in calculating implied volatility which is much more complicated because its just a projection. In financial mathematics the implied volatility IV of an option contract is that value of the volatility of the underlying instrument which when input in an option pricing model such as BlackScholes will return a theoretical value equal to the current market price of said optionA non-option financial instrument that has embedded optionality such as an interest rate cap can also.

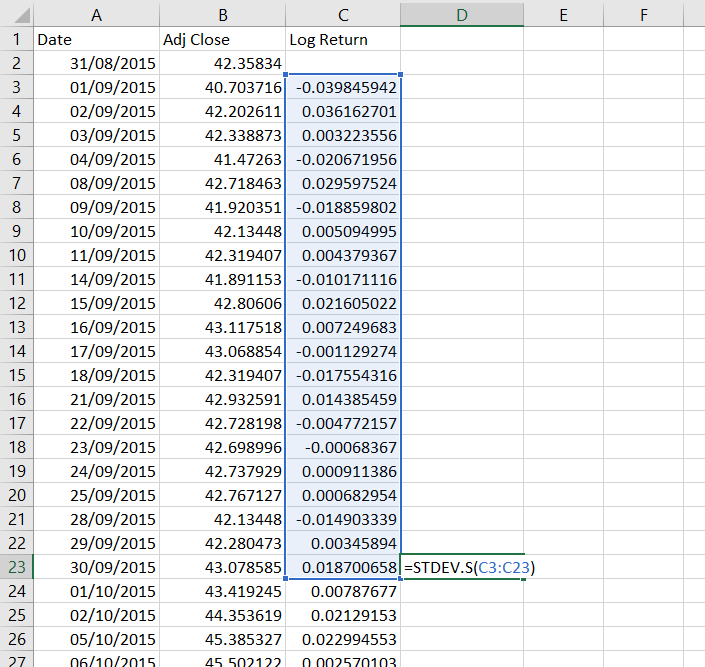

This square root measures the deviation of a set of returns perhaps daily weekly or monthly returns from their mean. We have setup an excel template that we can use to calculate the intrinsic value of a stock using the Ben Graham Formula. Examples provided in chart above are for instructional purposes only.

Risk-free rate and the euro-zone risk-free rates both annualized are 5 and 4 respectively. This calculation can be complex and time-consuming but using Excel calculating an assets historical volatility. Foreign Exchange Risks Example.

It can invest the same in US corporate bonds and earn a return of 25 pa. Gain B E1Probability of Gain B F1. A US-based multinational wishes to invest surplus funds of USD 1 million.

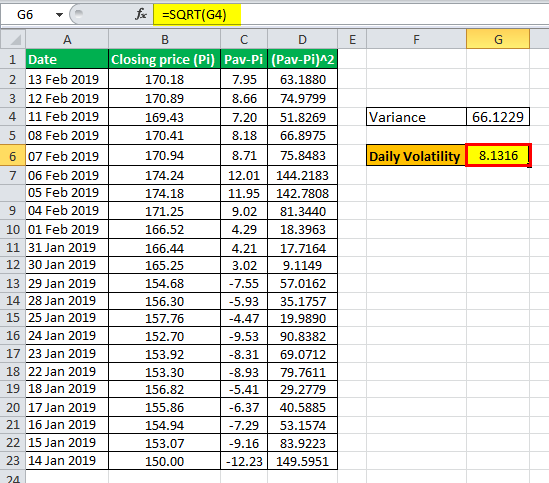

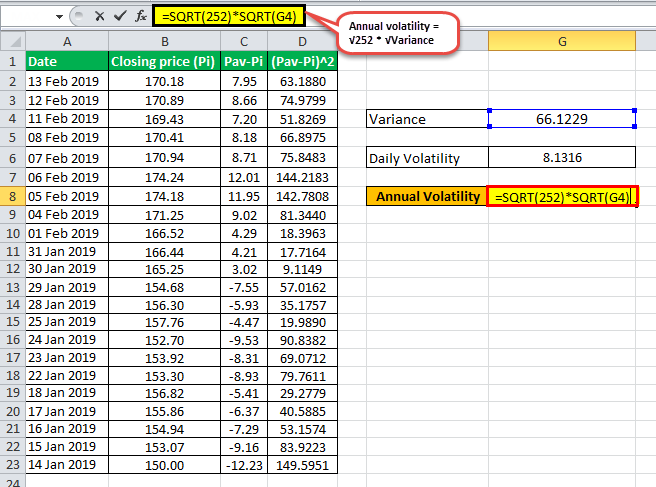

The volatility is calculated as the square root of the variance S. Marshall 2015 Isolating the systematic and unsystematic components of a single stocks or portfolios standard deviation Applied Economics 471 1-11 DOI. Implied volatility is a critical component of option valuations.

Volatility is derived from the variance of price movements on an annualized basis. How an exchange rate is determined is dependent on the exchange rate regime adopted by a given country. Follow these steps to calculate a stocks expected rate of return in Excel.

To assess whether options may be undervalued or overvalued the historical volatility and implied volatility Implied Volatility IV Implied volatility or simply IV uses the price of an option to calculate what the market is saying about the future volatility of the are compared to one another. HV is a common measure in risk assessment. R H rate of return in the home or base currency.

The current exchange rate is 125 100. In MarketXLS you can calculate the model value in a very simple way. What I do to correct for inflation is I first calculate my XIRR.

We are unique among global exchange operators in our ability to drive the global marketplace forward through product innovation leading edge technology and seamless trading solutions. A currencys value fluctuates based on factors like supply and demand a countrys economic stability and global events. Calculate Expected Rate of Return on a Stock in Excel.

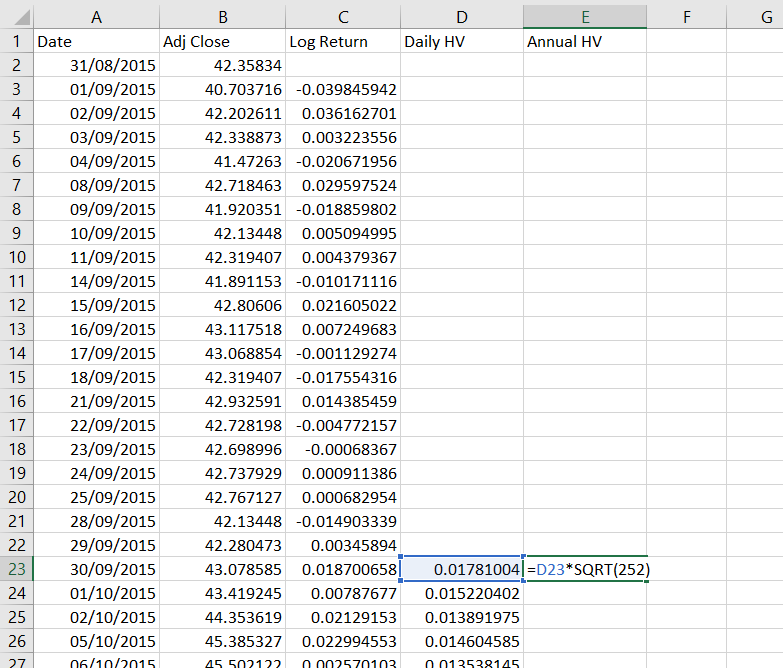

This is the volatility during this time. It is important for analyst to exercise care while choosing an appropriate growth rate. To calculate the annualized historical volatility enter SQRT252C23 in cell C24.

Step 1 Download the Colgate Excel Model Ratio Analysis Template. The Parallels Between Life and the Markets Read More. An example is given in the spreadsheet below scroll to the bottom for the download link but lets go through a.

Then I subtract it from the return. A call option is the right but not the obligation to purchase a currency pair at a specific exchange rate on or before a certain date. Ben Graham Formula in Excel.

How To Calculate Historical Volatility In Excel Macroption

Calculate Implied Volatility With Vba

Volatility Formula Calculator Examples With Excel Template

How To Calculate Annualized Volatility The Motley Fool

How Do You Calculate Volatility In Excel

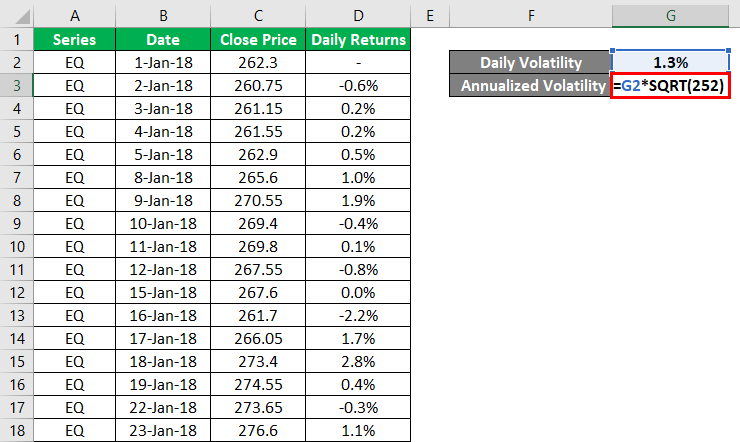

Volatility Formula How To Calculate Daily Annualized Volatility In Excel

Volatility Calculation Historical Varsity By Zerodha

Volatility Formula How To Calculate Daily Annualized Volatility In Excel

Implied Volatility Implementation In Excel Download Scientific Diagram

What Is Volatility And How To Calculate It Ally

How To Calculate Annualized Volatility The Motley Fool

Calculate Implied Volatility In Excel

Computing Historical Volatility In Excel

Volatility Formula Calculator Examples With Excel Template

How To Calculate Historical Volatility In Excel Macroption

How To Calculate Historical Volatility In Excel Macroption

How Do You Calculate Volatility In Excel

Volatility Formula Calculator Examples With Excel Template

Volatility Formula How To Calculate Daily Annualized Volatility In Excel